My Journey with Tactical Asset Allocation

Many people who know me know I am passionate about how money works. It's the oldest concept on the planet and one of the most complex man-made mechanisms. Many think of money simply: a transaction to buy or sell something, save and invest, or get paid for work. Still, its evolution over thousands of years has created many issues for humanity. I want to share some thoughts on it. It's the entire basis of why we have marketing, of course. haha

I grew up in a relatively poor or poor middle-class farming community in the center of Washington State. My parents were barely High School educated, and two of my grandparents only made it to the 8th grade. All struggled during their lives. There were some successes in pockets across the family, but for the most part, no one knew much about money, and if they did, they did not pass it on to me. Over time, I had to learn as much as possible about the real world and how to make, save, invest, and even spend money correctly. I am still learning, and it has been a roller coaster of a journey.

I have been fortunate in my life and career after I left my little poor patch in WA - the tech industry has been generous. Still, it was not without long hours, lots of stress, and hard work; it forced me to pay more attention than most to stay ahead because I did not have the foundations of most of my peers. I see many of them achieving far more today than I have dreamed of or even having the ability to achieve. Finding mentors to help me was another issue; people I could trust were elusive due to my upbringing and the attention economy. So, I went it alone without much help except for a few extraordinary people who decided to give me a chance. Still, I am grateful for having the opportunity to be included and associated with all of them.

Because of all this, luckily, out of sheer coincidence, I learned to latch on to tech early in my life. The Tech industry helped me make more, save more, and eventually learn more about investing. At first, I was like most people with money, and I still am for the most part - I did not strike it rich with stock options, the lucky startup culture, or even Bitcoin. I made average salaries, and I would do the normal mass market buy and sell individual stocks after I had saved a couple of thousand dollars.

"This looks like a great company," and off to the races. I would buy individual companies' stock.

It was no different than gambling, and I was naive, like most Main Street employees, in this approach. During my formative years, I was romanticized by the movies on money topics, from Alex P Keaton on Family Ties, aka Michael J Fox, and Charlie Sheen and Michael Douglas in Wall Street. All of these types of things warp our everyday common sense. Over time, after buying individual stocks, it warped my sense of taking risks in my own life because I lost a lot and learned many lessons. I converted to being more fiscally and socially conservative (however, I am a political Liberal); I did not start a family, I did not start a business, or do things that would be risky financial behavior. I was boring AF. Most likely still am to this day. I was scared of my vulnerabilities, trusting others, and growing old. I never felt secure enough to adopt the standard approaches of family building blocks everyone else was doing. It's too late now, of course. Those are different articles; let's return to investing and my approaches.

Eventually, this lack of risk-taking led me to more conservative investments and the hiring of a CFP/CFA to help me with my wealth plan for the future. They convinced me to invest in ETFs, but they only knew a little more than me about actively managing the investments except adjusting or reallocating them annually. It was your traditional buy-and-hold mentality that the financial institutions promoted with Modern Portfolio Theory, aka 60/40 buy/hold portfolio, or buying meme stocks with Robinhood. There is nothing wrong with it per se, but it is fraught with risk and huge losses when significant drawdowns occur, like in 2001, 2009, 2015, 2020, and 2022. These years had vast drawdowns of 10-30% or more in some cases. I experienced them along with everyone else – some people who were more educated during these periods got lucky, but most of us didn't. The CFA/CFPs sure didn't, but they still made their fee of 1% or more from my portfolio AUM, whether I made any returns or not.

So I decided to start managing my own portfolio in Vanguard and slimmed down to 3-5 ETFs - I did much better over about 10 years than the CFPs ever did for me. However, there were still huge risks with drawdowns, and I experienced them similarly. It often took 1-2 years to get back to the start even point from loss. While the ETFs were well diversified across 1000s of global stocks, I still needed to make more headway. All the returns were based on my saving 40-70% of my take-home pay, not compounding returns, let alone no consistent distribution of returns, which is the goal. I needed to learn more. Eventually, I came across another approach in May 2020, after the massive drawdown due to Covid.

I found out about Tactical Asset Allocation, or TAA for short. It falls within the active investing category compared to the traditional buy-and-hold approach. I will talk about other approaches further in the article. TAA is the approach I have finally found that works consistently for me to reduce risk and lower drawdowns during stock market declines compared to the methods the CFPs and Wall Street were promoting, especially buy and hold and modern Portfolio theory. 2022 was a huge loss in the Bond market nearly 50% drawdown. If I were still in Buy/Hold I would have lost 30% or more of my portfolio only 2 years after the 25% Covid drawdown. This would have been detrimental to me, considering I am now unemployed and supporting an elderly parent's living situation.

TAA prevented a huge drawdown for me in 2022 and recovered all my losses plus more after Covid. It smoothed my distribution of returns without having to recover from the % losses. In addition, it has proven to provide more consistent and better CGR(compounding growth rate) returns because it smooths the distributions by lowering the drawdowns that occur annually and monthly.

Because of this smoothing, TAA can help build wealth more consistently monthly and annually - it is not fast or "get rich quick scheme," but it does reduce stress and risk. It seemed counter-intuitive but proved itself as you looked through the historical back-testing numbers. Now I have real-life proof with tracking of my portfolio for the last 4.5yrs. What convinced me is that it's all math-based, global, and hits every asset class category. The asset classes were also eye-opening because when some asset classes are in a negative drawdown, others are going positive - in other words, there is always a bull market in one asset class while a bear is going on in another. With TAA, you buy the asset class as it's expanding and sell when it's declining before it severely declines – it's not market timing but market trending and momentum based on economic and match indicators for each ETF in the library across all asset classes. For example, TAA told me to buy heavily into Commodities in late 2020 and early 2021 - I would have never thought to do this; TAA then sold off the commodities a little later and bought into other assets; in 2022, I was mainly in cash. FYI, cash is still an asset class.

I still had a down year in 2022, but it was a fraction of what others had gone through and better than I would have had if I were still using the buy/hold method, and I would never have recovered all of it back in 2023. It would have taken 2 full years to get back to even, or longer, with buy and hold. TAA is a risk reducer in the short term and, over time, improves the compounding math of your returns. The earlier you plug into it, the better off you are - it takes about 2-3 years to benefit. I wish I had known about the process 10-15 years ago. Because for every 10% decline in your portfolio, you need 11.1% to recover, this is a massive insight with money and compounding. This is why I never saw growth year over year with the investment returns portion and had to make up for it in savings. I could never recover because the returns distribution would always be negative or slightly positive but never consistent. It's the same with most portfolios the Financial industry promotes to everyone.

For most of these people, wealth is their primary residence. Very few of us become wealthy from the stock market. I don't want to say it's a conspiracy, but it is for many of us based on how Wall Street collects its fees based on a % of AUM(Assets under Management). TAA changed the game for me and my outlook on wealth through active ETF management vs. passive buy and hold of ETFs.

Meb Faber of Cambria Investment Group wrote a fantastic whitepaper and then a free Kindle book on the concept of TAA - he called it Global Tactical Asset Allocation, or GTAA for short. It completely changed my mind and approach to investing and maintaining my savings without risking everything. Still, TAA has been around in hedge funds and large financial organizations for years, each making billions of dollars each year off the approaches Ray Dalio, Bill Ackman, and many other famous Quants use TAA. All Meb Faber did was expose it. It's controversial, and Financial firms don't promote it - they use it for their HNWI's and internally for themselves. The strategies that make up the TAA universe are diverse and complex, some very sophisticated and some very esoteric. A small company called Allocatesmartly.com has created a tool that lets you combine multiple model strategies in an ensemble approach, like the Hedge funds do, to help you improve and grow your money at a fraction of the cost.

I have tried all the approaches listed in this article, such as hiring financial advisors, CFA/CFPs, Robo-advisor tools, and even on my own. I no longer use these approaches - TAA and Allocatesmartly are now my active investment advisors - telling me when to trade and what to buy and sell monthly in my Vanguard accounts. The closest approach to TAA is the Robo-advisors. Unfortunately, they still go with the buy-and-hold approach of Modern Portfolio Theory. They also take a big AUM fee of .5-1.5% of your portfolio. While I advocate and use Vanguard as my low-cost broker to make my monthly trade, I no longer advocate for the Robo-advisors, active brokers at the big banks, or private advisors like CFP/CFA types. They are too expensive and provide little value-add to my long-term goals or help me make the compounding returns I should be making.

Various Investment Approaches and Strategies

Modern portfolio theory (MPT):

This is the most common Main Street approach. It is a framework for constructing portfolios that aim to maximize returns for a given level of risk. The approach is based on the idea that investors can achieve higher returns and lower risk by diversifying their portfolios across all asset classes. MPT is a relatively long-term buy-and-hold investment approach that focuses on identifying a mix of assets expected to provide the highest potential returns for the level of risk acceptable to the investor. Per above, it is the most common CFP, robo-advisor, and promoted approach in mass-market investing. It is not a bad approach, but it is prone to huge drawdowns, and regardless of the diversification approach, the buy/hold approach is its downfall.

Global Asset Allocation:

Global asset allocation is a broader investment approach that involves diversifying a portfolio across multiple asset classes and regions to achieve the desired level of risk and return. Global Asset Allocation Strategies are based on various factors, including market conditions, economic indicators, investors' risk tolerance, and investment objectives. As a result, global asset allocation strategies may be more flexible than MPT and involve making more frequent and potentially more significant changes to the portfolio in response to changing market conditions.

Tactical Asset Allocation:

At the basic definition, this approach is a more actively managed approach to asset allocation that involves making more frequent and potentially more significant changes to the portfolio in response to changing market conditions. Tactical asset allocation strategies may involve shifting between asset classes and regions to exploit opportunities and mitigate risk. A Bull in one Asset Class means there is a bear in another and vice versa. Meb Faber mentioned above combined Global Asset Allocation with TAA. Then Allocatesmartly.com created a library of TAA mathematical models designed and open-sourced in the industry by the hedge fund quants and academics. This approach allows a portfolio to trade across a stack of ETF assets and ETF asset classes that the model library uses when market conditions change. Some models are strict and brittle, while others span many assets and move more nimbly. Combining strategies in an ensemble gives you the best of all market conditions based on your risk tolerance and adjusts the buy and sell when those conditions change to smooth out your returns.

Tactical Asset Allocation Strategies

Quantitative analyst experts develop their models using different tactical asset allocation strategy approaches. Some popular methods include:

- Market timing: This tactical asset allocation strategy involves buying and selling assets based on predictions about market trends. It involves anticipating market movements to buy assets when they are undervalued and sell them when they are overvalued.

- Sector rotation: This tactical asset allocation strategy involves shifting between different sectors or industries to exploit opportunities and mitigate risk. It analyzes market conditions and economic indicators to identify industry sectors that perform well and allocate assets accordingly.

- Asset class rotation: This tactical asset allocation strategy involves shifting between different asset classes to take advantage of opportunities and mitigate risk. It analyzes market conditions and economic indicators to identify asset classes expected to perform well and allocate assets accordingly.

- Dynamic asset allocation: This is a tactical asset allocation strategy that involves continuously adjusting the allocation of assets within a portfolio in response to changing market conditions. It analyzes market conditions and economic indicators to identify opportunities and adapt the portfolio.

- Canary Universe: Refers to a group of securities or financial instruments that are used to monitor market conditions and inform trading decisions. The term "canary" is used because these securities are thought to be sensitive to changes in market conditions, and their performance can serve as an early warning of potential shifts in the market. Often, a Canary will be used in a TAA strategy to inform the model what other assets to buy or sell in a given month based on the performance, momentum, economic conditions, etc...

- Adaptive Asset Allocation (AAA): This is a TAA strategy that involves dividing a portfolio into several asset classes, such as stocks, bonds, commodities, and real estate, and using a set of rules to determine the appropriate allocation of assets within the portfolio based on market conditions.

- Dual momentum: This TAA strategy combines trend-following and relative strength momentum to identify and invest in upward-trending assets.

- Momentum-based rotation: This TAA strategy involves rotating between different asset classes based on momentum to identify and invest in asset classes expected to perform well.

- Value-based rotation: This TAA strategy involves rotating between different asset classes based on valuations to identify and invest in undervalued assets.

Individuals can use many different tactical asset allocation strategies to manage their portfolios. Of course, the appropriate strategy will depend on the investor's financial goals, risk tolerance, and other factors. Luckily, experts have distilled many approaches into math models and are open-sourced

Since tactical asset allocation is a more actively managed approach, it involves making more frequent and potentially more significant changes to the portfolio in response to changing market conditions. It is based on the idea that by actively managing the allocation of assets within a portfolio, it is possible to take advantage of opportunities and mitigate risk in a way that helps maximize and smooth the distribution of returns over long periods, as I have mentioned above with my own firsthand experience.

70 Published TAA Models on Allocatesmartly

Here is a brief overview of 70 tactical asset allocation strategies on Allocatesmartly, along with potential pros and cons. They have added a few more since I started writing this article. After much research, I annotated the four I use in my mixed combined ensemble and the weightings I prescribe for myself. You can read more about this and more on Allocatesmartly.com.

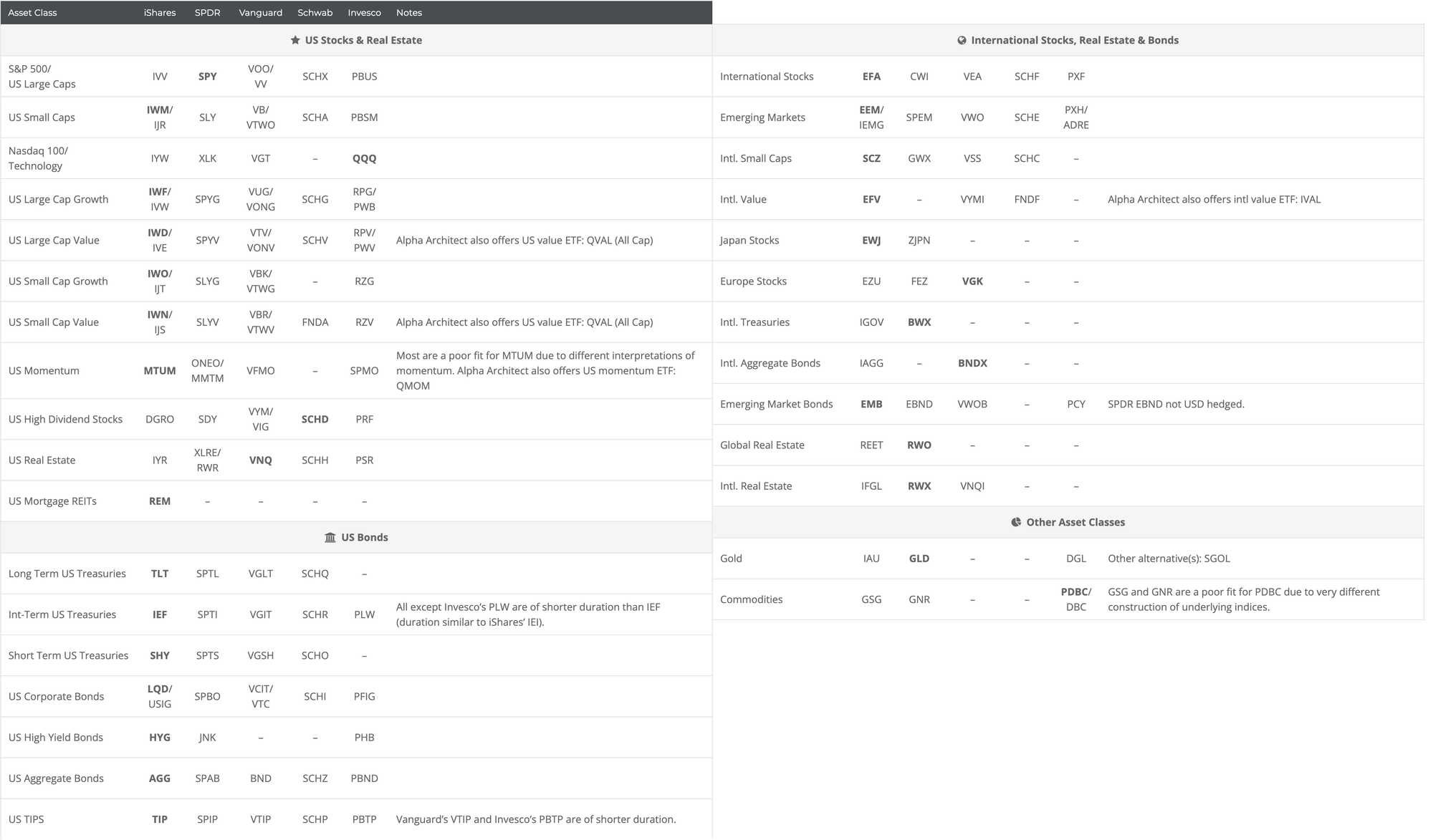

Here are all the assets and asset classes the models chose from monthly:

Here is the strategy model list:

60/40 Benchmark: No, not a TAA model. It is used as the benchmark for all the other models. The 60/40 investment strategy is a traditional buy/hold approach to portfolio management that involves dividing a portfolio into two main asset classes: stocks and bonds. The portfolio is typically allocated 60% to stocks, which have the potential to generate higher returns over the long term but also carry higher levels of risk, and 40% to bonds, which help to diversify the portfolio and reduce overall risk.

This strategy is based on modern portfolio theory (MPT), a framework for constructing portfolios that maximize returns for a given level of risk. Due to its simplicity, it is often used as a benchmark for other investment strategies. It is also considered a form of global asset allocation, which involves diversifying a portfolio across multiple asset classes and regions. However, it is not necessarily a tactical asset allocation strategy, which involves making more frequent and potentially larger changes to the portfolio in response to changing market conditions. You can include it in an ensemble mix, making it a library option.

Accelerating Dual Momentum: One of the original TAA strategies. This strategy involves allocating to the asset classes with the highest momentum, with the weightings of the different assets adjusted based on their momentum. The main pros of this approach are the potential for strong returns and the ability to adapt to changing market conditions. However, momentum strategies can also be prone to underperforming during prolonged periods of market decline.

Allocatesmartly uses an ADM model developed by EngineeredPortfolio.com. It combines trend-following and relative strength momentum to identify and invest in assets expected to perform well.

The Accelerating Dual Momentum strategy involves dividing a portfolio into several asset classes, such as stocks, bonds, commodities, and real estate. It then uses a set of rules to determine the appropriate allocation of assets within the portfolio based on market conditions. These rules are based on a combination of trend-following and relative strength momentum. They may include factors such as valuations, trends, and correlations between different asset classes.

One key feature of the Accelerating Dual Momentum strategy is the use of acceleration, which refers to increasing the weight of assets that are performing well and decreasing the weight of assets that are performing poorly. This contrasts traditional dual momentum strategies, which may maintain a constant weighting of assets regardless of their performance.

Overall, the Accelerating Dual Momentum strategy is a tactical asset allocation approach that involves combining trend-following and relative strength momentum to identify and invest in assets expected to perform well. It is based on the idea of using acceleration to increase the weight of assets performing well and decrease the weight of assets performing poorly.

Adaptive Asset Allocation: This approach involves adjusting the portfolio's asset allocation based on a variety of factors, including macroeconomic indicators, technical analysis, and fundamental analysis. The main pro of this approach is the potential to adapt to changing market conditions. However, it can also be time-consuming and may require a significant amount of research and analysis to decide if this will work for you.

All-Weather Portfolio: This strategy involves maintaining a fixed allocation to a diversified set of assets, including stocks, bonds, gold, and other commodities, to provide relatively consistent returns in various market environments. The main pro of this approach is the potential for relatively low volatility and consistent returns. However, it may also produce lower returns in strong market environments. Ray Dalio and his hedge fund Bridgewater Assoc. are famous for developing this strategy.

Aspect Partners' Risk Managed Momentum: This strategy involves allocating to the asset classes with the highest momentum and incorporating risk management techniques to reduce the impact of market declines. The main pros of this approach are the potential for strong returns and the inclusion of risk management techniques. However, it may still be prone to underperforming during prolonged periods of market decline.

Bold Asset Allocation - Aggressive: This strategy involves a more aggressive approach to asset allocation, with a higher allocation to stocks and other riskier assets. The main pro of this approach is the potential for strong returns in bullish market environments. However, it may also be more volatile and underperform in bearish market environments. This strategy along with many more published on Allocatesmartly was developed by Wouter Keller. An Academic at the University of Amsterdam in the Netherlands. I allocate 17% of my portfolio to this model.

Bold Asset Allocation - Balanced: This strategy is similar to the Aggressive version, but with a more balanced allocation between stocks and other assets. The main pros of this approach are the potential for strong returns and a lower level of volatility compared to the Aggressive version. However, it may still underperform in bearish market environments.

Classical Asset Allocation - Defensive: This strategy involves maintaining a more conservative allocation to a diversified set of assets to preserve capital and provide relatively stable returns. The main pros of this approach are the potential for low volatility and consistent returns. However, it may also produce lower returns in strong market environments.

Classical Asset Allocation - Offensive: This strategy is similar to the Defensive version, but with a more aggressive allocation to a diversified set of assets. The main pro of this approach is the potential for higher returns compared to the Defensive version. However, it may also be more volatile and may underperform in bearish market environments.

Composite Dual Momentum: This strategy involves allocating to the asset classes with the highest momentum, using a combination of relative strength and trend-following indicators. The main pros of this approach are the potential for strong returns and the ability to adapt to changing market conditions. However, momentum strategies can also be prone to underperforming during prolonged periods of market decline. This strategy is broadly based on Gary Antonacci's paper: Risk Premia Harvesting Through Dual Momentum. The model considers both absolute and relative momentum to trade a larger basket of asset classes than his more well-known traditional dual momentum strategy

Countercyclical Trend Following: This strategy involves allocating asset classes expected to outperform during different phases of the market cycle. The main pro of this approach is the potential to adapt to changing market conditions. However, it may be difficult to accurately predict the market cycle and may require a significant amount of research and analysis to decide if this will work for you.

Davis' Three-Way Model: This strategy involves allocating to a diversified set of assets based on their expected risk and return characteristics. The main pros of this approach are its potential to adapt to changing market conditions and the inclusion of a risk management component. However, it may require significant research and analysis to implement effectively.

Defensive Asset Allocation: This strategy involves maintaining a more conservative allocation to a diversified set of assets to preserve capital and provide relatively stable returns. The main pros of this approach are the potential for low volatility and consistent returns. However, it may also produce lower returns in strong market environments.

Efficient Index: This is an index-based investment strategy that allocates to a diversified set of assets based on their expected risk and return characteristics. The main pros of this approach are the potential for relatively low costs and diversification. However, it may not be as flexible as other tactical asset allocation strategies. It may not be able to adapt to changing market conditions as effectively.

Elastic Asset Allocation - Defensive: This strategy involves maintaining a more conservative allocation to a diversified set of assets, while also adjusting the allocation based on changes in market conditions or the expected performance of different asset classes. The main pros of this approach are the potential for low volatility and the ability to adapt to changing market conditions. However, may require a significant amount of research and analysis to decide if this will work for you.

Elastic Asset Allocation - Offensive: This strategy is similar to the Defensive version, but with a more aggressive allocation to a diversified set of assets. The main pro of this approach is the potential for higher returns compared to the Defensive version. However, it may also be more volatile and may underperform in bearish market environments.

Faber's Global Tactical Asset Alloc. - Agg. 3: Meb Faber developed this tactical asset allocation strategy, which involves allocating to a diversified set of global assets based on their expected risk and return characteristics. This approach has the main pros of the potential for strong returns and the inclusion of a risk management component. However, may require a significant amount of research and analysis to decide if this will work for you. I used this strategy along with META mentioned below for all of 2020 and 2021 until I learned more about the other strategies.

Faber's Global Tactical Asset Alloc. - Agg. 6: This is a similar strategy to the Agg. 3 version, but with a more aggressive allocation to global assets. The main pro of this approach is the potential for higher returns compared to the Agg. 3 version. However, it may also be more volatile and may underperform in bearish market environments.

Faber's Global Tactical Asset Alloc. 13: This is another tactical asset allocation strategy developed by Meb Faber that involves allocating to a diversified set of global assets based on their expected risk and return characteristics. The main pros of this approach are the potential for strong returns and the inclusion of a risk management component. However, may require a significant amount of research and analysis to decide if this will work for you.

Faber's Global Tactical Asset Alloc. 5: This is a similar strategy to the 13 version, but with a slightly different asset allocation. The main pros of this approach are the potential for strong returns and the inclusion of a risk management component. However, may require a significant amount of research and analysis to decide if this will work for you.

Faber's Ivy Portfolio: This is a tactical asset allocation strategy developed by Meb Faber that involves allocating to a diversified set of global assets based on their expected risk and return characteristics. The main pros of this approach are the potential for strong returns and the inclusion of a risk management component. However, may require a significant amount of research and analysis to decide if this will work for you.

Faber's Sector Relative Strength: This is a tactical asset allocation strategy developed by Meb Faber that involves allocating to sectors of the stock market based on their relative strength. The main pros of this approach are the potential for strong returns and the ability to adapt to changing market conditions. However, it may be prone to underperforming during prolonged periods of market decline.

Faber's Trinity Portfolio Lite: This is a tactical asset allocation strategy developed by Meb Faber that involves allocating to a diversified set of global assets based on their expected risk and return characteristics. The main pros of this approach are the potential for strong returns and the inclusion of a risk management component. However, may require a significant amount of research and analysis to decide if this will work for you.

Financial Mentor's All-Weather Quad Mom.: This is a tactical asset allocation strategy that involves allocating to a diversified set of assets based on their momentum and other factors. The main pros of this approach are the potential for strong returns and the ability to adapt to changing market conditions. However, momentum strategies can also be prone to underperforming during prolonged periods of market decline.

Financial Mentor's Optimum 3: This is a tactical asset allocation strategy that involves allocating to a diversified set of assets based on their expected risk and return characteristics. The main pros of this approach are the potential for strong returns and the inclusion of a risk management component. However, it may require a significant amount of research and analysis to implement effectively. I allocate 19% of my portfolio to this strategy.

Flexible Asset Allocation: This is a tactical asset allocation strategy that involves adjusting the portfolio's asset allocation in response to changing market conditions or the expected performance of different asset classes. The main pro of this approach is the ability to adapt to changing market conditions. However, it may require a significant amount of research and analysis to implement effectively.

Generalized Protective Momentum: This is a tactical asset allocation strategy that involves allocating to a diversified set of assets based on their momentum and other factors. The main pros of this approach are the potential for strong returns and the ability to adapt to changing market conditions. However, momentum strategies can also be prone to underperforming during prolonged periods of market decline. I allocate 25% of my portfolio to this strategy.

Glenn's Paired Switching Strategy: This is a tactical asset allocation strategy that involves rotating between pairs of assets based on their relative strength. The main pros of this approach are the potential for strong returns and the ability to adapt to changing market conditions. However, it may be prone to underperforming during prolonged periods of market decline.

Glenn's Quint Switching Filtered: This is a tactical asset allocation strategy that is similar to the Paired Switching Strategy, but with a larger number of assets and the inclusion of filters to reduce risk. The main pros of this approach are the potential for strong returns and the inclusion of risk management techniques. However, it may still be prone to underperforming during prolonged periods of market decline.

Global Risk Parity Trend Following: This is a tactical asset allocation strategy that involves allocating to a diversified set of global assets based on their risk and return characteristics, as well as trend-following indicators. The main pros of this approach are the potential for strong returns and the inclusion of risk management techniques. However, it may be difficult to accurately predict trends and may require a significant amount of research and analysis to implement effectively.

Golden Butterfly: This is a tactical asset allocation strategy that involves rotating between a small number of assets based on their relative strength and other factors. The main pros of this approach are the potential for strong returns and the ability to adapt to changing market conditions. However, it may be prone to underperforming during prolonged periods of market decline.

Growth-Trend Timing - Original: This is a tactical asset allocation strategy that involves rotating between different asset classes based on their expected growth and trend characteristics. The main pros of this approach are the potential for strong returns and the ability to adapt to changing market conditions. However, it may be difficult to accurately predict growth and trends, and may require a significant amount of research and analysis to implement effectively.

Growth-Trend Timing - UE Rate: This is a similar tactical asset allocation strategy to the Original version, but with a focus on the unemployment rate as a key indicator. The main pros of this approach are the potential for strong returns and the ability to adapt to changing market conditions. However, it may be difficult to accurately predict the unemployment rate and may require a significant amount of research and analysis to implement effectively.

Hybrid Asset Allocation: The last 39% of my portfolio is allocated to Hybrid Asset Allocation - Balanced - and Simple - https://allocatesmartly.com/dr-keller-keunings-simple-variation-of-hybrid-asset-allocation/. You may or may only have access to this strategy description if you have a membership to Allocatesmartly. This strategy comes from Dr. Wouter Keller and JW Keuning's paper: Dual and Canary Momentum with Rising Yields/Inflation: Hybrid Asset Allocation (HAA). I allocate 39% of my Portfolio to this strategy.

Kipnis' Defensive Adaptive Asset Allocation: This is a tactical asset allocation strategy that involves adjusting the portfolio's asset allocation based on a variety of factors, including macroeconomic indicators, technical analysis, and fundamental analysis, with a focus on risk management. The main pros of this approach are the potential to adapt to changing market conditions and the inclusion of risk management techniques. However, it may require a significant amount of research and analysis to implement effectively.

Lethargic Asset Allocation: This is a tactical asset allocation strategy that involves maintaining a more conservative allocation to a diversified set of assets, with the goal of preserving capital and providing relatively stable returns. The main pros of this approach are the potential for low volatility and consistent returns. However, it may also produce lower returns in strong market environments.

Link's Global Growth Cycle: This is a tactical asset allocation strategy that involves rotating between different asset classes based on their expected growth and trend characteristics. The main pros of this approach are the potential for strong returns and the ability to adapt to changing market conditions. However, it may be difficult to accurately predict growth and trends, and may require a significant amount of research and analysis to implement effectively.

Livingston's Mama Bear Portfolio: This is a tactical asset allocation strategy that involves maintaining a more conservative allocation to a diversified set of assets, with the goal of preserving capital and providing relatively stable returns. The main pros of this approach are the potential for low volatility and consistent returns. However, it may also produce lower returns in strong market environments.

Livingston's Papa Bear Portfolio: This is a tactical asset allocation strategy that is similar to the Mama Bear Portfolio, but with a more aggressive allocation to a diversified set of assets. The main pro of this approach is the potential for higher returns compared to the Mama Bear Portfolio. However, it may also be more volatile and may underperform in bearish market environments.

Allocate Smartly Meta Strategy: This is a META tactical asset allocation strategy that combined multiple strategies form the Library in this list and then involves allocating to a diversified set of assets based on a variety of factors, including macroeconomic indicators, technical analysis, and fundamental analysis. The main pros of this approach are the potential to adapt to changing market conditions and the inclusion of a variety of analytical techniques. However, it may require a significant amount of research and analysis to implement effectively.

Momentum Turning Points: This is a tactical asset allocation strategy that involves rotating between different asset classes based on their momentum and other factors. The main pros of this approach are the potential for strong returns and the ability to adapt to changing market conditions. However, momentum strategies can also be prone to underperforming during prolonged periods of market decline.

Movement Capital's Composite Strategy: This is a tactical asset allocation strategy that involves allocating to a diversified set of assets based on a variety of factors, including macroeconomic indicators, technical analysis, and fundamental analysis. The main pros of this approach are the potential to adapt to changing market conditions and the inclusion of a variety of analytical techniques. However, it may require a significant amount of research and analysis to implement effectively.

Newfound's Diversified Dual Momentum: This is a tactical asset allocation strategy that involves allocating to a diversified set of assets based on their momentum and other factors. The main pros of this approach are the potential for strong returns and the ability to adapt to changing market conditions. However, momentum strategies can also be prone to underperforming during prolonged periods of market decline.

Novell's Bond UI1: This is a tactical asset allocation strategy that involves allocating to a diversified set of bond assets based on their expected risk and return characteristics. The main pros of this approach are the potential for relatively stable returns and the inclusion of a risk management component. However, bond returns may be lower than those of other asset classes, and the strategy may underperform in a rising interest rate environment.

Novell's Bond-COMP: This is a tactical asset allocation strategy that involves allocating to a diversified set of bond assets based on their expected risk and return characteristics. The main pros of this approach are the potential for relatively stable returns and the inclusion of a risk management component. However, bond returns may be lower than those of other asset classes, and the strategy may underperform in a rising interest rate environment.

Novell's SPY-COMP: This is a tactical asset allocation strategy that involves allocating to a diversified set of equity assets based on their expected risk and return characteristics. The main pros of this approach are the potential for strong returns and the inclusion of a risk management component. However, equity investments can be more volatile than other asset classes and may underperform in bearish market environments.

Novell's Tactical Bond Strategy: This is a tactical asset allocation strategy that involves allocating to a diversified set of bond assets based on their expected risk and return characteristics. The main pros of this approach are the potential for relatively stable returns and the inclusion of a risk management component. However, bond returns may be lower than those of other asset classes, and the strategy may underperform in a rising interest rate environment.

Optimal Trend Following: This is a tactical asset allocation strategy that involves allocating to a diversified set of assets based on their trend characteristics and other factors. The main pros of this approach are the potential for strong returns and the ability to adapt to changing market conditions. However, it may be difficult to accurately predict trends and may require a significant amount of research and analysis to implement effectively.

Permanent Portfolio: This is a tactical asset allocation strategy that involves allocating to a diversified set of assets in a relatively fixed proportion, with the goal of providing stable returns over the long term. The main pros of this approach are the potential for low volatility and consistent returns. However, it may also produce lower returns in strong market environments.

Predicting US Treasury Returns: This strategy involves attempting to forecast the future returns of US Treasury securities, and then adjusting the portfolio's allocation to these securities based on the expected returns. One potential pro of this strategy is that it may allow an investor to potentially outperform a passive benchmark by making more informed decisions about asset allocation. However, there are several potential cons to consider as well. Forecasting the future returns of any asset can be difficult, and it is especially challenging to predict the returns of US Treasury securities, which are often seen as a safe haven asset. In addition, this strategy may require a lot of time and resources to implement effectively, and there is no guarantee that it will produce superior results.

Protective Asset Allocation - CPR: Protective asset allocation is a strategy that aims to protect a portfolio from significant losses by allocating a higher portion of the portfolio to defensive assets such as cash, bonds, and other low-risk investments. One potential pro of this strategy is that it may help to reduce volatility and risk in the portfolio, which can be appealing to risk-averse investors. However, there are also several potential cons to consider. Allocating a higher portion of the portfolio to defensive assets may result in lower returns during periods of market growth, as these assets tend to have lower returns than riskier assets like stocks. In addition, it may be difficult to predict when to shift the portfolio's allocation between defensive and more aggressive assets, which can make it challenging to implement this strategy effectively.

Protective Asset Allocation: This strategy is similar to the Protective Asset Allocation - CPR strategy described above, but it may involve a more specific set of rules or criteria for determining the appropriate allocation to defensive assets. The pros and cons of this strategy are likely to be similar to those of Protective Asset Allocation - CPR.

Resilient Asset Allocation: This strategy involves allocating assets in a way that is designed to allow the portfolio to withstand market downturns and recover more quickly from losses. One potential pro of this strategy is that it may help to reduce the overall risk of the portfolio and improve its resilience during times of market volatility. However, there are also several potential cons to consider. It may be difficult to predict which assets will perform well during market downturns, and there is no guarantee that a resilient asset allocation will actually help a portfolio recover more quickly from losses. In addition, this strategy may require a lot of time and resources to implement effectively, and it may not produce superior results compared to other tactical asset allocation strategies.

Risk Premium Value - Best Value: This strategy involves selecting assets based on their expected risk premium, which is the amount of return an asset is expected to provide above and beyond the risk-free rate of return. One potential pro of this strategy is that it may allow an investor to potentially outperform a passive benchmark by making more informed decisions about asset allocation. However, there are also several potential cons to consider. Forecasting the expected risk premium of an asset can be difficult, and there is no guarantee that a portfolio constructed using this strategy will actually outperform a passive benchmark. In addition, this strategy may require a lot of time and resources to implement effectively, and it may not produce superior results compared to other tactical asset allocation strategies.

Risk Premium Value - Weighted: This strategy involves allocating assets based on their expected risk and return, with a focus on maximizing the risk-adjusted return of the portfolio. One advantage of this approach is that it can help investors identify undervalued assets that may provide higher returns. However, it can also involve a significant amount of research and analysis, which can be time-consuming.

Robust Asset Allocation - Aggressive: This strategy involves taking a more aggressive approach to asset allocation, with a higher allocation to risky assets such as stocks. One advantage of this approach is that it can potentially lead to higher returns in a rising market. However, it also carries a higher risk of loss in a market downturn.

Robust Asset Allocation - Balanced: This strategy involves a more balanced approach to asset allocation, with a mix of risky and conservative assets. This approach may be more suitable for investors who are looking for a combination of potential growth and stability. However, it may also result in lower returns compared to a more aggressive approach.

Sell in May/Halloween Indicator: This strategy involves selling stocks in the summer months (May to October) and going to cash, based on the belief that the stock market tends to underperform during this period. One advantage of this approach is that it can potentially reduce the risk of loss in a market downturn. However, it also carries the risk of missing out on potential gains during the rest of the year.

Stoken's Active Combined Asset - Daily: This strategy involves actively adjusting the allocation of an investor's portfolio on a daily basis. One advantage of this approach is that it allows investors to quickly respond to market conditions. However, it can also involve a significant amount of time and effort to monitor the market and make frequent adjustments. Stoken's Active Combined Asset - Monthly: This strategy involves actively adjusting the allocation of an investor's portfolio on a monthly basis. This approach may be more suitable for investors who do not have the time or resources to make daily adjustments. However, it may also result in lower returns compared to a daily strategy if market conditions change rapidly.

Traditional Dual Momentum: This strategy involves ranking assets based on their momentum, or the rate at which their price is rising or falling, and allocating assets to those with the highest momentum. Pros: Can potentially capture trends and generate higher returns. Cons: Can be difficult to implement and may not perform well in certain market conditions. Traditional Dual Momentum: This strategy involves combining both absolute and relative momentum to identify attractive investment opportunities. Absolute momentum measures the trend of an asset's price, while relative momentum compares the performance of an asset to a benchmark. One advantage of this approach is that it can potentially provide higher returns in a rising market. However, it also carries the risk of underperforming in a falling market.

US Cross-Asset Momentum: This strategy involves ranking assets based on their momentum across multiple asset classes, such as stocks, bonds, and commodities. Pros: Can potentially capture trends in a variety of asset classes and generate higher returns. Cons: Can be difficult to implement and may not perform well in certain market conditions.US Cross-Asset Momentum: This strategy involves identifying assets that are showing momentum across different asset classes, such as stocks, bonds, and commodities. One advantage of this approach is that it can potentially provide diversification and reduce the risk of losses in a single asset class. However, it may also be more complex to implement and may require a larger portfolio to achieve a sufficient level of diversification.

US Equal Risk Contribution: This strategy involves allocating assets such that the contribution of each asset to the overall risk of the portfolio is equal. Pros: Can potentially reduce portfolio risk and improve diversification. Cons: May not generate as high returns as other strategies and may not perform well in certain market conditions. US Equal Risk Contribution: This strategy involves allocating assets based on their contribution to the overall risk of the portfolio, with the goal of achieving a more balanced and diversified portfolio. One advantage of this approach is that it can potentially reduce the risk of losses in a market downturn. However, it may also result in lower returns compared to a more aggressive approach.

US Max Diversification: This strategy involves maximizing the diversification of the portfolio by allocating assets to a wide range of asset classes and sectors. Pros: Can potentially reduce portfolio risk and improve diversification. Cons: May not generate as high returns as other strategies and may not perform well in certain market conditions. US Max Diversification: This strategy involves maximizing the diversification of the portfolio by including a wide range of assets. One advantage of this approach is that it can potentially reduce the risk of losses in a market downturn. However, it may also result in lower returns compared to a more concentrated portfolio.

US Max Sharpe: This strategy involves maximizing the Sharpe ratio, which is a measure of risk-adjusted return, by allocating assets to those with the highest Sharpe ratio. Pros: Can potentially generate higher risk-adjusted returns. Cons: May not perform well in certain market conditions and can be difficult to implement. US Max Sharpe: This strategy involves maximizing the Sharpe ratio of the portfolio, which is a measure of risk-adjusted return. One advantage of this approach is that it can potentially provide higher returns for a given level of risk. However, it may also involve a significant amount of research and analysis to identify the optimal asset allocation.

US Min Correlation: This strategy involves minimizing the correlation, or statistical dependence, between assets in the portfolio by allocating assets to those that are uncorrelated or negatively correlated. Pros: Can potentially reduce portfolio risk and improve diversification. Cons: May not generate as high returns as other strategies and may not perform well in certain market conditions. US Min Correlation: This strategy involves selecting assets that have low correlation with each other, with the goal of reducing the overall risk of the portfolio. One advantage of this approach is that it can potentially reduce the risk of losses in a market downturn. However, it may also result in lower returns compared to a more concentrated portfolio.

US Risk Parity Trend Following: This strategy involves allocating assets based on a combination of risk parity, which aims to equalize the contribution of each asset to portfolio risk, and trend following, which involves following trends in asset prices. Pros: Can potentially reduce portfolio risk and improve diversification while capturing trends. Cons: May not perform well in certain market conditions and can be difficult to implement. US Risk Parity Trend Following: This strategy involves allocating assets based on their risk and return potential, with a focus on achieving a balance of risk across the portfolio. It also involves using trend-following techniques to identify opportunities to buy or sell assets. One advantage of this approach is that it can potentially provide higher returns for a given level of risk. However, it may also involve a significant amount of research and analysis to identify the optimal asset allocation.

Tactical Permanent Portfolio: This strategy involves maintaining a fixed allocation to various asset classes and rebalancing the portfolio periodically to maintain that allocation. One advantage of this approach is that it can provide a measure of stability and diversification. However, it may also result in lower returns compared to more actively managed strategies if market conditions change significantly.

Varadi's Minimum Correlation Portfolio: This strategy involves selecting assets that have low correlation with each other, with the goal of reducing the overall risk of the portfolio. One advantage of this approach is that it can potentially reduce the risk of losses in a market downturn. However, it may also result in lower returns compared to a more concentrated portfolio.

Varadi's Percentile Channels: This strategy involves identifying assets that are trading within certain price ranges, or "channels," and allocating assets based on their relative strength within those channels. One advantage of this approach is that it can potentially identify undervalued assets that may provide higher returns. However, it may also involve a significant amount of research and analysis to identify the optimal asset allocation.

Vigilant Asset Allocation - Aggressive: This strategy involves taking a more aggressive approach to asset allocation, with a higher allocation to risky assets such as stocks. One advantage of this approach is that it can potentially lead to higher returns in a rising market. However, it also carries a higher risk of loss in a market downturn.

Vigilant Asset Allocation - Balanced: This strategy involves a more balanced approach to asset allocation, with a mix of risky and conservative assets. This approach may be more suitable for investors who are looking for a combination of potential growth and stability. However, it may also result in lower returns compared to a more aggressive approach.

Many more are added to the library every day. I think it is a better alternative than the mass market pitches. It takes more active management and research, but it has helped my stress and given me more peace of mind. It may not seem to perform well for immediate gratification as you watch the portfolio, but the long-term distribution of returns indisputably makes it a winner over buy-and-hold. It isn't for everyone because it does force you to manage it and actively participate.

I hope you enjoyed this article.