An Investing Story: My “Aha Moment”

Originally published in Sept2022

I began my investment journey three decades ago at 27y.o. in 1996. I was in significant debt then; my net worth was negative $100k. Over the years, I tried various traditional investment approaches, but none worked in the long run. The 60/40, 70/30, and 80/20 allocations suggested by financial experts and popular investment theories like Modern Portfolio Theory failed to deliver the results I desired.

The problem with these approaches became apparent during market downturns. A 10% decline in my portfolio required an approximately 11.1% growth to break even. Then, every % point above that was a positive return. So, if the market dropped 10% one year, the following year, you would need 11.1% plus more to move the needle back to the previous year. So if there is a big downturn, like 20% (aka Covid March 2020) you needed 25% the following year to break even. 30% is 42.5%. This made it challenging to see substantial progress, and I began to feel frustrated and exhausted from working long hours and traveling for business.

In 2013, I decided to take control of my financial destiny. I had approximately $300k in total assets, including my house equity, so I sought guidance from websites like PersonalCapital.com and Todd Tressider at financialmentor.com. These resources helped me become more financially aware and develop a wealth plan aligned with my life goals. By November 2017, approximately 1,500 days later, my net worth had reached my $1,000,000 goal in paper assets only through dedicated savings and some luck with market timing. However, I was still treading water and paying 1% to a CFP. Todd's content convinced me to move in completely different directions. I couldn't keep up the pace, and corporate America has its own risks, as you are working for someone else, and your job, as I learned later, was never a guarantee.

Todd's course consists of approximately 7 modules. It teaches the basic foundational aspects, and as it expanded, it went into deep risk management and wealth planning. Lastly, as I mentioned below, he introduced a tool I had been searching for over the last decade to replace CFPs. I am a big advocate of Todd and his course. Just to let you know, his approach is contrarian and a philosophy many will not accept or grasp.

Before he introduced this tool, I was still dissatisfied with traditional investment approaches. I wondered why I couldn’t achieve a consistent 8-10% Compound Annual Growth Rate (CAGR) and why the stock market gains didn’t match my savings rate. The financial industry’s recommended strategies like dollar-cost averaging, Robo-advisors, and the advice of Certified Financial Planners (CFPs) and Chartered Financial Analysts (CFAs) were inadequate.

When the Covid pandemic hit in March 2020, my portfolio experienced a severe decline, almost dropping below the $1,000,000 mark. I realized I needed a different approach to reduce risk, move assets efficiently, and increase my CAGR.

That’s when I discovered Allocatesmartly.com, by Todd Tressider, from Financialmentor.com. Allocatesmartly is a company that offers Tactical Asset Allocation (TAA) strategies. This approach involved actively managing my investments based on market momentum and adjusting my asset allocations monthly. I decided to give it a shot, and the results were remarkable. By July 2023, three and a half years later, my net worth had grown 12% CAGR, primarily attributed to my use of Allocatesmartly.com. It reduced my risk through the 2022 market and world turmoil. I did have % drawdowns in some months, but I adjusted and recovered. If I wasn't using Allocatesmartly, I am very positive my Networth would be below the $1M mark today that I achieved in 2017 due to all the market drawdowns.

I am not a financial expert, nor do I work in the financial industry. My success results from 30 years of trial and error, trying various investment approaches as an individual. I urge everyone to do their research and due diligence to find what works best. TAA with Allocatesmartly.com was the game-changer I needed to secure my financial future. Yours might be a different path, but I encourage you to explore this option.

As a single man in my 50s with no family to rely on, I realized the importance of saving and investing for my later years. Sacrificing some luxuries allowed me to live below my means and build a solid financial foundation. I’ve learned not to trust mass-market financial pitches and media circus articles. The key is managing your money, actively investing, and taking charge of your financial future.

Managing my finances with Allocatesmartly.com and the Tactical Asset Allocation (TAA) approach has been a game-changer. I now control my investments and can adapt quickly to market changes. Allocatesmartly.com offers a wide range of TAA strategies I can mix into a single model, providing monthly allocation adjustments based on my chosen investment models.

The investing world can be overwhelming, with numerous approaches and strategies available. The options seem endless, from Value Investing to Growth Investing, Income Investing, and Sector Investing. However, after trying many of these approaches, I found that Tactical Asset Allocation best suited my needs, simplifying my investing while reducing my stress.

Allocatesmartly.com’s TAA strategies cover a vast array of options, such as:

- All-Weather Portfolio

- Risk-Managed Momentum by Aspect Partners

- Bold Asset Allocation (Aggressive and Balanced)

- Classical Asset Allocation (Defensive and Offensive)

- Composite Dual Momentum

- Countercyclical Trend Following

- Davis’ Three-Way Model

- Elastic Asset Allocation (Defensive and Offensive)

- Faber’s Global Tactical Asset Allocation (Agg. 3, Agg. 6, 13, and 5) - Meb Faber

- Faber’s Ivy Portfolio

- Faber’s Sector Relative Strength

- Faber’s Trinity Portfolio Lite

- Financial Mentor’s All-Weather Quad Momentum - Todd's model

- Financial Mentor’s Optimum 3 - Todd's model

- Flexible Asset Allocation

- Generalized Protective Momentum

- Glenn’s Paired Switching Strategy

- Glenn’s Quint Switching Filtered

- Global Risk Parity Trend Following

- Golden Butterfly

- Growth-Trend Timing (Original and UE Rate)

- Kipnis’ Defensive Adaptive Asset Allocation (KDAA)

- Lethargic Asset Allocation

- Link’s Global Growth Cycle

- Livingston’s Mama Bear Portfolio

- Livingston’s Papa Bear Portfolio

- Allocate Smartly Meta Strategy

- Momentum Turning Points

- Movement Capital’s Composite Strategy

- Newfound’s Diversified Dual Momentum

- Novell’s Bond UI1, Bond-COMP, and SPY-COMP

- Novell’s Tactical Bond Strategy

- Optimal Trend Following

- Permanent Portfolio

- Predicting US Treasury Returns

- Protective Asset Allocation (CPR and standard)

- Resilient Asset Allocation

- Risk Premium Value (Best Value and Weighted)

- Robust Asset Allocation (Aggressive and Balanced)

- Sell in May/Halloween Indicator

- Stoken’s Active Combined Asset (Daily)

- Traditional Dual Momentum

- US Cross-Asset Momentum

- US Equal Risk Contribution

- US Max Diversification

- US Max Sharpe

- US Min Correlation

- US Risk Parity Trend Following

- Tactical Permanent Portfolio

- Varadi’s Minimum Correlation Portfolio

- Varadi’s Percentile Channels

- Vigilant Asset Allocation (Aggressive and Balanced)

It may sound overwhelming, but Allocatesmartly.com makes choosing the right TAA strategies for my portfolio easy. Having my investments actively managed monthly allows me to stay ahead of market trends and make informed decisions. You will need to evaluate and play with what works best for you.

Update Sept 2023: I adjusted my portfolio strategies. I’ve done this a bit over time but overall it doesn’t radically affect the assets availability. I’m now allocated as follows: FinancialMentorOptimum 3: 45%, Hybrid Asset Allocation 30%, Bold asset allocation 25%, FinancialMentor Allweather quad 5%.

Update: Jan. 2024: I am now using Bold Asset Alloc. Aggressive — 22%, Fin.Mentor Opt3 -17%, Hybrid Asset Alloc.25% and Generalized Protective Momentum — 32%, Cash — 4%

Update: Jan. 2025: I am now using Meb Faber GTAA-3 — 31%, Fin.Mentor Opt3 -32%, FinMentor All-weatherQuad.32%, Cash — 5% - After running multiple tests over 5 yrs, these are the three best models for my situation. Nothing is perfect, but I have learned they seem stable and not as finicky as some other models.

I have exceeded 20% in the last 11 months with this configuration, which took some trial and error to final commit to.

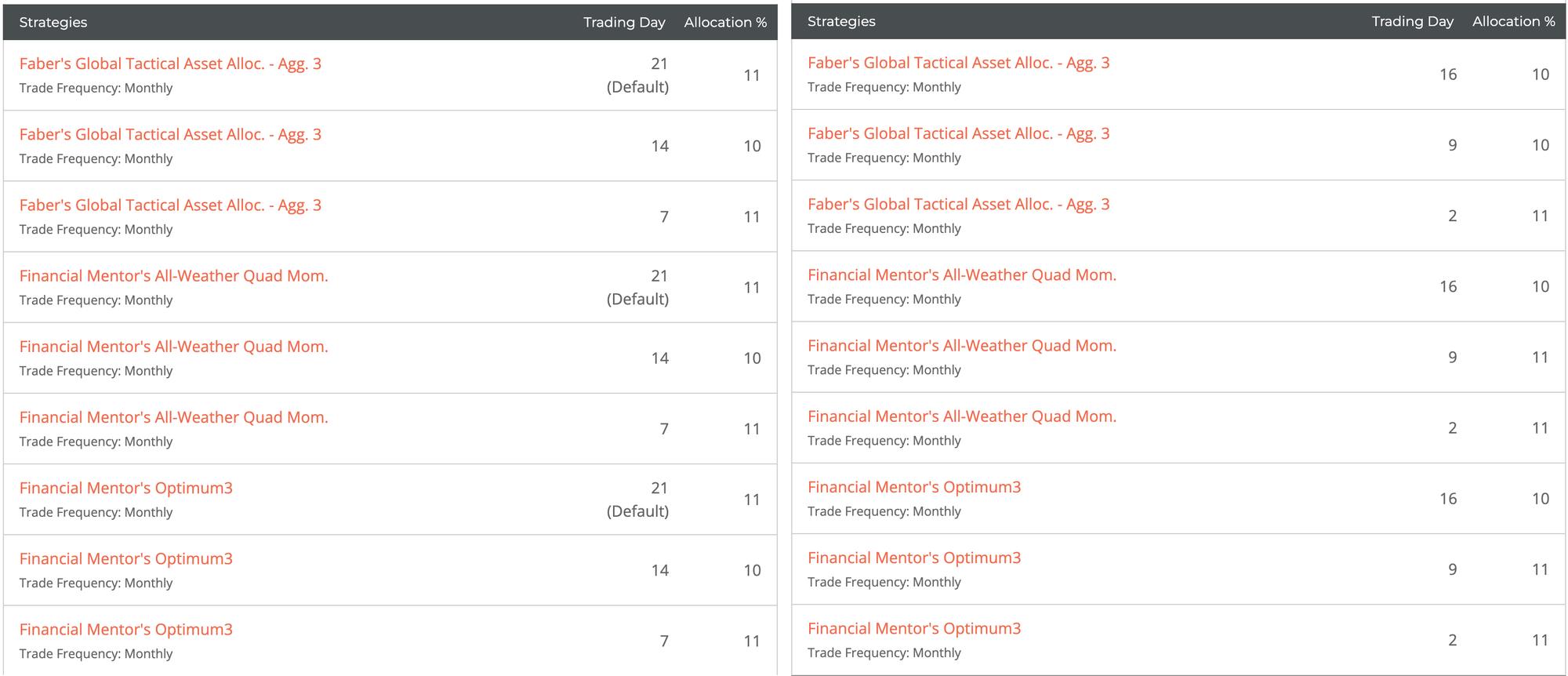

I also TRANCHE into 3 separate virtual aggregations of my accounts to make each virtual account mutually exclusive from the others. The Financial Mentor community discussed this in forums ad nauseam, as it is a feature inherent in Allocatesmartly's tool. Here is what the Tranche config looks like for two different date cycles. 7-14-21 or 2-9-16. Basically, three trades per month, with each trade equidistant from the others for statistical validity.

As a single individual, I’ve learned to prioritize financial security in my later years, understanding that I’ll be responsible for my well-being. Living below my means, saving diligently, and investing with Allocatesmartly.com’s TAA approach, I’ve seen my net worth grow steadily.

My success story is unique to my circumstances and preferences. Each individual’s financial journey will be different, and finding an approach that aligns with your goals and risk tolerance is important.

The financial industry often promotes its products and services. Still, taking control of my investments and actively participating in my financial planning is the most effective approach. By researching and staying informed, I can make decisions that suit my needs and ultimately secure my financial future.

In conclusion, my investing journey has been one of self-discovery and persistence. Through trial and error, I found that Tactical Asset Allocation with Allocatesmartly.com was the key to unlocking financial success and I recommend you check out Todd Tressider's FinancialMentor courses. As a single individual focused on securing my financial future, I’ve learned the value of managing my money and actively investing in my investments.

My story inspires others to take control of their financial destiny, do their due diligence, and find the best approach. Remember, the financial industry is a business, and its offerings may not always be in your best interest. Take charge of your finances, invest wisely, and secure your future on your terms.